Whether you do it for yourself or your clients, tax preparation is cumbersome. Regardless of your expertise, you will still require assistance when preparing taxes. This is why you need tax preparation software. Whether you are an individual tax preparer, a tax professional, or an accounting firm, having a suitable suite of tax preparation software helps you file taxes quickly, maximize productivity, and simplify the tax filing process.

TaxWise software is one such software program on which most tax professionals rely. They use the software’s desktop edition to streamline e-filing and handle client records online. However, leading businesses are migrating to TaxWise cloud solutions due to certain drawbacks in the TaxWise desktop edition. These include lack of remote access, issues with team collaboration, less security of data, etc.

Here we will discuss how TaxWise cloud hosting solution can benefit you and help you overcome the challenges of the desktop edition. Read on!

How Can Accounting Firms Benefit from TaxWise Hosting?

Using a locally-hosted TaxWise solution has certain drawbacks, which can deteriorate your tax filing experience. These include the inability to access data remotely, issues with collaboration, etc. With TaxWise accounting software hosting in place, you can mitigate such hurdles effectively. Here’s how:

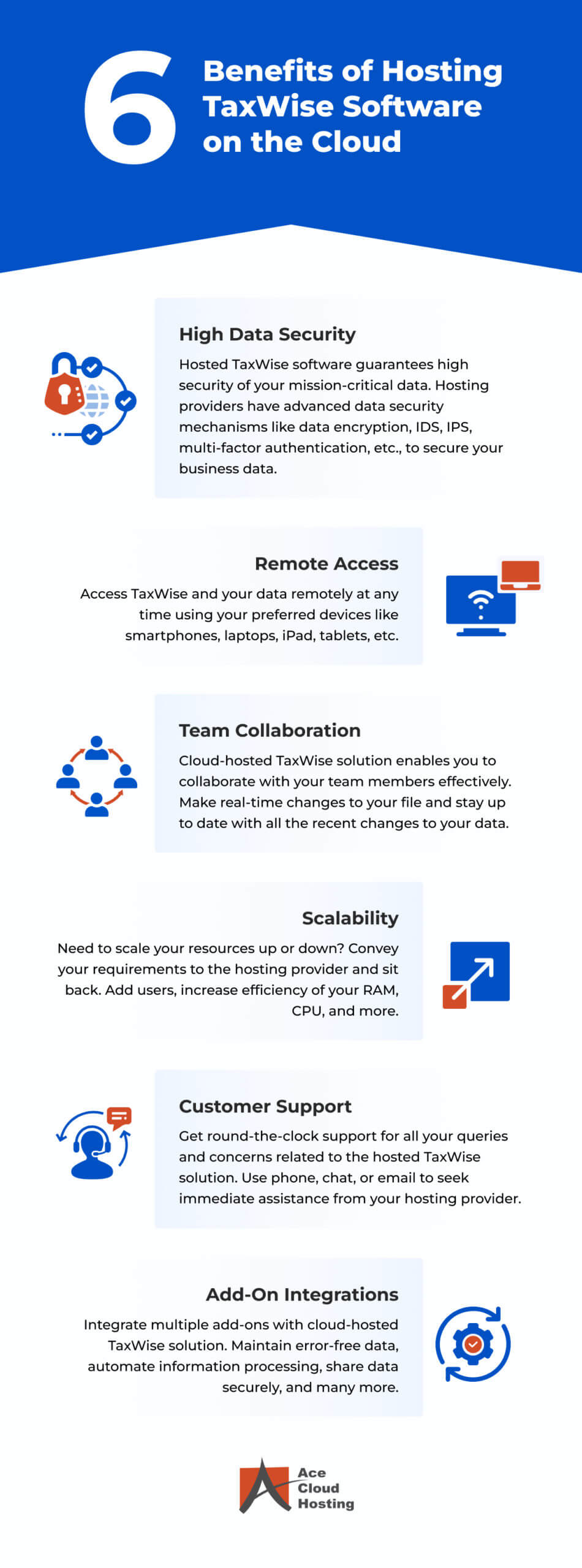

1. Data Security: Regardless of the size of a company, data security is always a common concern among all. The problem usually arises when migrating your TaxWise software to the cloud. Your business data must remain secure when the application is hosted on the cloud server of a third-party service provider. A single incident of a data breach can ruin your business.

With TaxWise cloud solutions in place, you can ensure the complete security of your mission-critical business data. It is because the leading cloud hosting providers deploy multiple security protocols to ensure the safety of their customers. These include:

- End-to-end data encryption

- Multi-factor authentication

- Intrusion Detection System (IDS) and Intrusion Prevention System (IPS)

- Multi-level Firewalls

- Antivirus and Antimalware

In addition to the above, the cloud hosting providers keep a regular check at the incoming data. Further, they analyze those data constantly and ensure its security from potential cyberattacks.

2. Remote Accessibility: Hosting TaxWise on the cloud enables you to access the application from anywhere and at any time. You can use your preferred devices like smartphones and tablets to access the software. TaxWise remote access helps you maintain a work-life balance while simplifying your job and increasing your efficiency and productivity.

By having remote access to TaxWise, you can eliminate the requirement of setting up a physical space for your employees. Further, you don’t need an in-house IT infrastructure to invest in, as your Taxwise accounting software hosting provider hosts the application on their cloud servers.

3. Team Collaboration Gets Easier: Taxwise cloud solutions are an excellent way to help you communicate and collaborate with your team members irrespective of anyone’s geographical location. You can share all your TaxWise files and data in real time. Besides, if anyone edits a file, that will be visible to the rest of the team members in real time. Moreover, you don’t need to maintain multiple versions of the same file and don’t need to share files via email. Everyone can work on the same file simultaneously. Such features of TaxWise cloud solutions help accounting firms be more productive as they don’t need much time to prepare and file taxes.

4. Scalability: Availing TaxWise accounting software hosting services from a reliable hosting provider enables you to scale your resources. All you need to do is inform your service provider about your requirements, and they will do the needful.

For instance, you need to hire more accountants and give them access to TaxWise or need to increase the memory and storage capacity of your infrastructure. In such cases, you can convey the requirements to your hosting provider and scale up the resources. Once your requirements are fulfilled, or you no longer need them, you can, again, contact the service provider to scale down the resources. This way, you pay only for the services you use and fully use the flexible pricing model of your hosting provider.

5. Customer Support: Having round-the-clock customer support for TaxWise hosting services is essential. Instances might occur when you encounter challenges in accessing the hosted software or your data. In such cases, you must be able to reach out to the customer support team of your cloud hosting provider and seek immediate assistance.

Leading TaxWise cloud solution providers have skilled professionals who provide 24×7, 365 days of IT support to their customers. You can contact them via various means such as phone, chat, email, etc. When selecting a TaxWise hosting provider, ask about the multiple means of customer support communication and if they are available round the clock.

6. Add-On Integrations: While cloud-hosted TaxWise is a complete package in itself, instances might occur when you require different functions which are not available on the hosted application. This is where add-ons come in handy. You can integrate these third-party applications with hosted TaxWise and accomplish multiple objectives.

Conclusion

Hosted TaxWise software can reap multiple benefits for your accounting firm. Data security, remote access, collaboration, scalability, and customer support are just to name a few. TaxWise cloud solutions help you save significant revenue on hardware and bring massive transformation on how you increase business efficiency.