Cloud computing keeps on being an intriguing subject in the world of accounting professionals. The main reason behind its popularity is the ease of scalability and simplicity of system access it offers across the globe.

What is cloud computing?

Cloud computing is the delivery of computing services over the internet, including software, storage, and processing power, without the need for on-premises hardware or infrastructure.

Cloud computing is the future of the accounting industry. The new generation of entrepreneurs is already embracing the advantageousness of cloud computing in the field of accounting.

With the help of cloud computing, stakeholders, CPAs, and account managers have peace of mind when traveling, knowing they can get the required information instantly on their smart devices.

While traditional IT frameworks can prevent an accounting firm’s ability to work productively, a custom cloud arrangement can provide correct security privileges, data backup, and better control, helping accounting firms to diversify their business initiatives.

Many accounting firms are moving to the cloud because they are now able to comprehend the advantages such as better mobility and more comfortable interaction with clients.

Instead of spending a considerable number of dollars on servers and IT assets, administrators can concentrate on different aspects of their business when they run their accounting software on the cloud infrastructure. Access to the cloud system is attainable at any time and from any geographical location which helps in running the business successfully without missing a beat.

Benefits of Cloud Computing for CPAs:

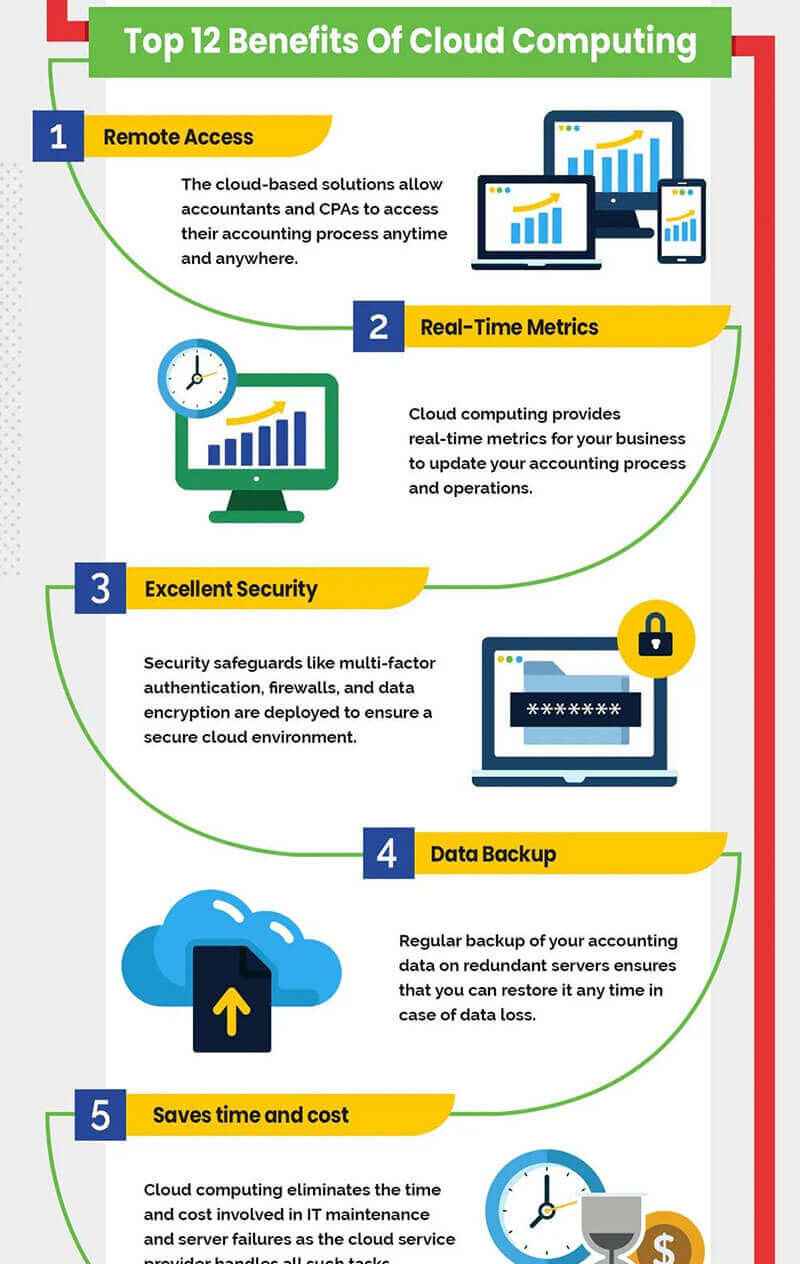

Here are the important benefits of cloud computing for CPAs and accounting firms:

Let’s explore why cloud computing is highly beneficial to CPA’s and Accountants.

1. Anytime Access from Anywhere

Cloud computing enables the firm’s staff to access their accounting data and applications anytime from anywhere with an internet connection through portable devices such as laptops, smartphones, and tablets. This is something impossible with today’s desktop accounting solutions.

Whether you are on holiday or a business trip, you can readily check your staff’s work, bank transactions, invoices, and business payments.

2. Real-Time Metrics

Cloud computing provides real-time metrics which helps in preparing and sharing cash flow, earnings, and tax statements simultaneously leading to improved transparency in work.

Decision makers can determine how well the organization is performing against company targets and analyze the information in real-time to lower the risk of errors in financial reports.

3. Enhanced Security

Switching to the cloud ensures the protection and integrity of clients’ data by diminishing the possibilities of data loss or computer failure.

Cloud security includes multiple tools like – Login management systems, encryption, and multi-factor authentication within the network infrastructure in order to provide continuity and protection to sensitive accounting data and transactions.

4. Data Backups

Losing valuable data can become costly and time-consuming for any business. Cloud technology allows accountants and CPAs to focus on their important tasks and become more productive by offering regular automatic backups.

Cloud data backups are excellent for providing redundancy and security for accounting businesses that want to ensure their critical data is available even in times of disaster like earthquakes or cyberattacks.

Through regular backup, firms can restore their accounting data. Data is often stored in different data centers in geographically diverse locations.

5. Time & Cost Savings

The cost-saving benefits that cloud computing brings are vital. It eliminates unnecessary expenses on maintenance, server failures, and other associated costs. This is because when you opt for cloud hosting services, the provider takes the responsibility of handling all such tasks that eventually reduce both capital as well as operating costs.

The accounting firm can choose the subscription that best suits their needs and pay depending on the specific requirements.

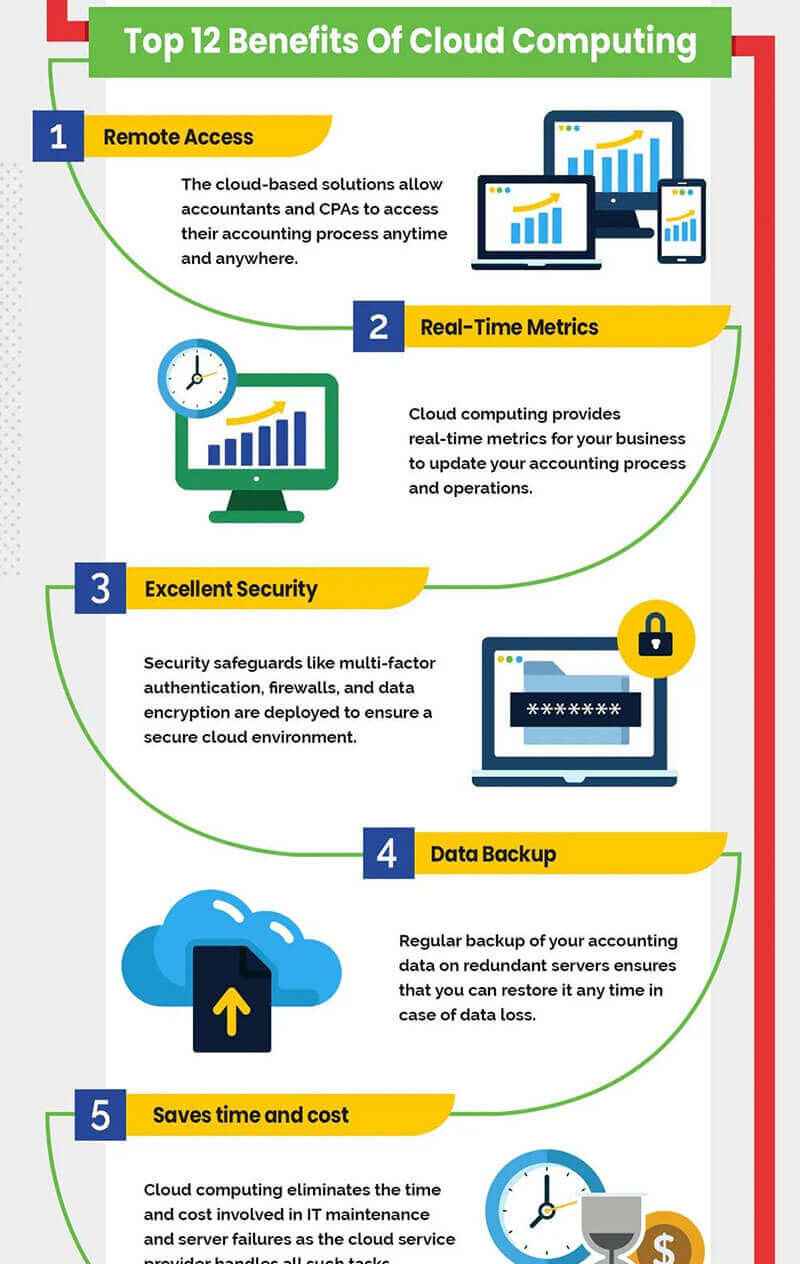

6. Flexibility and Scalability

Cloud computing allows firms to scale up or down the server resources and add/remove users according to their business requirements. The businesses can modify the resources along with the growing business and not worry about the hardware replacement.

Moreover, with the PAY-AS-YOU-USE pricing model, the users pay only for resources utilized by the accounting firm.

7. Automatic Updates & Upgrades

Cloud computing creates enhancements in the background without disrupting the customers’ work. The businesses can turn on/off new updates and features according to their firm’s requirements.

8. Builds Stronger Team-Client Relationships

Cloud computing empowers team and clients with efficient file sharing to trade and edit source documents and share files virtually, sparing the time and hassle.

Through access across all devices -laptop, mobiles, and apps, multiple users can collaborate and work together anywhere, anytime.

9. Eco-Friendly

By moving to the cloud, accounting firms contribute to the environment by minimizing the requirement of hardware on their premises. As the hardware required is minimum, the power needed are also minimized leading to a reduction in power consumption and optimum energy utilization.

Hence, the cloud eliminates unnecessary spending due to the use of energy efficient equipment and fewer carbon footprints. Moreover, if you opt for a green data center, it ensures that your data is stored on a cloud environment with appropriate procedures to deploy environment-friendly practices with cloud operations.

10. Better Control

When any firm or business moves to cloud computing, all files and data are shared centrally which enables the firms to edit and view them as per their requirements allowing to have better quality control over resources by granting permission for each user according to work assigned to them.

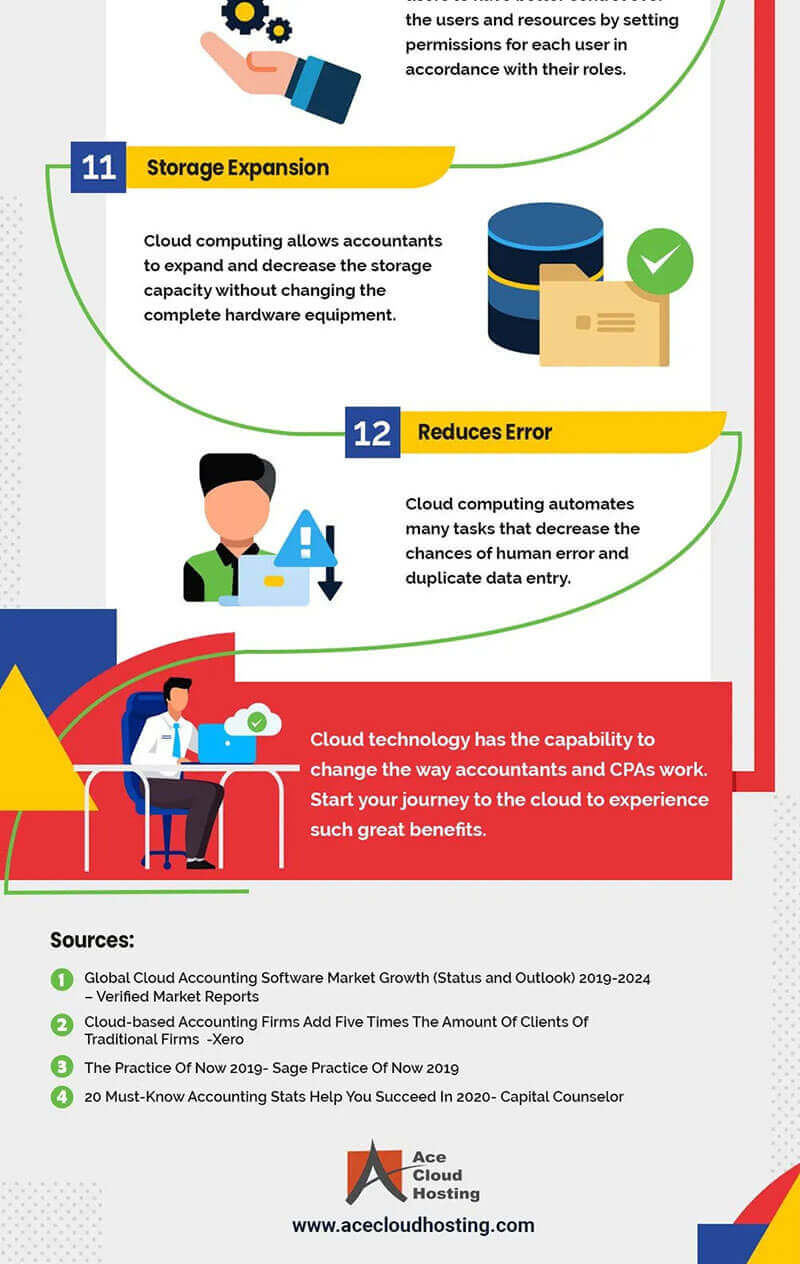

11. Expansion of File Storage

The steady growth of business calls for more demand in storage space, especially in accounting files which are generally considered to be heavier. Due to this, the accounting firms are forced to replace the hardware regularly leading to IT hassles.

However, cloud computing helps the accounting firms to expand or scale down their storage space at much-reduced costs, eliminating the purchase of expensive computer equipment or IT experts to maintain them.

12. Check Errors and Prevent Duplicity of Entries

Regardless of whether you go through a whole day with numbers utilizing manual accounting, there is yet the tiny probability of error or repetitive entry.

However, with cloud computing, the CPA’s and accountants free themselves from these issues as the cloud system will automatically correct any errors and checks duplicate entries on the financial records.

To Wrap It Up!

Cloud computing has become highly beneficial to accounting firms over the last few years. The possibilities and features of cloud accounting holds are endless in terms of time and costs. CPAs and accountants are becoming more mobile leading to less work in the fixed locations.

All accounting work that is processed and completed on the cloud increases business growth and meet the needs of rapidly changing markets.

Reduction in management workload allows accountants to view data in real-time, whether remotely or in the same room and focus more on production and innovation. Making the switch to cloud accounting increases a company’s cash flow and profits where half of the tasks like data security, security updates, cost-savings are performed by the chosen cloud service providers.

Hence, cloud computing is now a proven and important alternative technology that has made accountants relationships with their clients more effective by offering new services and applications for streamline data management.

Cloud computing benefits such as scalability, flexibility, and data backups have come on the upper list of benefits that excite accounting firms about cloud paradigm.

FAQs:

Q: How can cloud computing benefit CPAs and accounting firms?

Cloud computing can benefit CPAs and accounting firms in several ways, such as:

Cost savings: Cloud computing can reduce hardware and software costs, as well as the need for IT personnel to maintain on-premises systems.

Remote access: Cloud computing allows users to access accounting software and data from anywhere with an internet connection, which can increase productivity and enable remote work.

Scalability: Cloud computing enables firms to scale their computing resources up or down as needed, allowing them to accommodate fluctuations in demand without the need to purchase additional hardware.

Data security: Cloud computing providers typically offer advanced security features, such as data encryption, multi-factor authentication, and disaster recovery, that can help protect sensitive financial data.

Q: Are there any downsides to using cloud computing for accounting?

While cloud computing offers many benefits, there are some potential downsides to consider, such as:

Internet dependency: Cloud computing requires a stable and reliable internet connection, which can be a challenge in areas with limited or unreliable connectivity.

Data privacy concerns: Storing financial data in the cloud can raise privacy concerns, particularly if the data is stored in a location with less stringent privacy laws.

Vendor lock-in: Moving data and processes to the cloud can create a dependency on specific cloud computing providers, which can limit flexibility and create switching costs.

Overall, the benefits of cloud computing for CPAs and accounting firms typically outweigh the potential downsides, but it’s important to carefully evaluate the costs and benefits of any cloud computing solution before making a decision.

About Julie Watson

Julie is a dynamic professional with over 16 years of rich experience as a VDI and Application Hosting expert. At Ace Cloud Hosting, she humanizes disruptive and emerging remote working trends to help leaders discover new and better possibilities for digital transformation and innovation by using cloud solutions with an enterprise-class security approach. Beyond work, Julie is a passionate surfer.

On the weekend, you will find her hanging out with her family or surfing around the North Shore of Oahu.

Search

Popular Posts

We will contact you on the shared details to set up your free trial.

7-Day credit validity.